In the complex world of business operations, leaders often find themselves navigating a sea of financial statements and documents. While the income statement is a familiar companion, the often-overlooked cash flow statement is equally pivotal in understanding and steering a company’s financial well-being. Without a clear grasp of cash flow dynamics, managing a business can quickly turn into a perilous journey. In this article, we explore the significance of the cash flow statement, its benefits, and how to prepare one, all while highlighting the value of professional services like BlueStone in facilitating this essential financial tool.

Why the Cash Flow Statement Matters

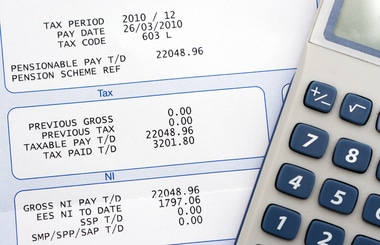

An income statement provides valuable insights into a company’s profitability, revenue, and expenses. Still, it falls short in capturing the intricate workings of a business’s finances. That’s where the cash flow statement comes into play. It offers a comprehensive view of how money moves in and out of a business, a crucial component in understanding its fiscal health. Here’s why it’s vital:

- Daily Financial Dynamics: A cash flow statement allows you to better comprehend the day-to-day financial ebbs and flows within your business. It paints a vivid picture of when and how money enters and exits your coffers, empowering you to make informed decisions on managing your resources effectively.

- Long-Term Financial Insights: Beyond the short-term, a cash flow statement provides a window into the long-term financial dynamics of your business. It helps you discern trends and patterns, giving you the foresight to anticipate upcoming financial needs and opportunities.

- Proactive Planning: With a cash flow statement, you can proactively plan for your business’s financial requirements. By identifying cash shortages or surpluses in advance, you can implement strategies to ensure your business remains stable and well-prepared for market opportunities.

- Optimizing Cash Flow: Preparing a cash flow statement can reveal opportunities for improving your cash flow. It highlights areas where you can cut costs, increase efficiency, or boost revenue, ultimately enhancing your financial sustainability.

- Lender Requirements: Financial institutions often require a cash flow statement when considering loans or credit lines. Having a well-prepared statement not only meets this requirement but also demonstrates your commitment to sound financial management.

- Peace of Mind: An effective cash flow statement can provide peace of mind, knowing that you have a firm grasp on your financial situation. This assurance can significantly reduce stress and anxiety associated with running a business.

Creating Your Cash Flow Statement

Many businesses prepare cash flow statements at least annually, with some opting for quarterly statements to maintain a firm financial grip. Preparing one may sound intimidating, but numerous resources are available to simplify the process. Online templates and financial software like QuickBooks offer convenient options to get started. Here’s a basic guide:

- Historical Data: Begin by creating a cash flow statement for the prior year. This will help you become familiar with the process and set a foundation for future projections.

- Expense and Income Categories: Categorize your cash flows into sections such as operating activities, investing activities, and financing activities. This segmentation provides clarity and precision in your analysis.

- Forecasting: Start projecting quarterly cash flow statements to anticipate your business’s financial needs and surpluses. This proactive approach enhances your ability to navigate financial challenges and seize opportunities.

How BlueStone Services Can Help

At BlueStone Services, we understand the paramount importance of accurate financial data and timely tax reporting. We specialize in helping businesses set up and manage customized cash flow statements tailored to their specific needs. Our expertise can relieve you of the burden of financial complexity and provide the peace of mind that comes with a well-structured financial plan.

For more information or to discuss how we can assist in fortifying your business’s financial foundation, don’t hesitate to contact us. Your financial success is our commitment, and we’re here to guide you through the intricacies of cash flow management.