Family offices act as the heart of a family’s operations, doing everything from managing their financial lives to overseeing their investments, paying bills, pursuing philanthropic activities and making travel arrangements. The scope of the family office’s operations depends on the family’s wishes, as well as its budget.

For many families, having a qualified team in place to manage the financial and business aspects of their wealth frees them to pursue their passions. This can work well — as long as the family takes the following important steps.

Step 1: Assess whether a dedicated family office is wanted and needed.

Running a family office is a lot like running a business: it takes time, money and dedication to do it well, so family members must ask themselves these questions:

- How much time do I want to commit to managing my family’s affairs?

- How much money should the family commit to this endeavor?

- How dedicated am I to ensuring the success of the family office?

As discussions progress, some families may find the expense too great in one or some of those categories. Those families often opt to go another route and become clients at a multifamily office. Multifamily offices have a team in place to manage the affairs of their clients in exchange for a fee that is based on the amount under management and the scope of services required.

Every business needs a leader, and if none emerges from these initial discussions, the family should consider evaluating other options. If a leader is identified, it is time to move on to drafting a formal mission statement.

Step 2: Draft a formal mission statement.

Once a family decides it wishes to form a family office, it needs to have a serious discussion that culminates in the drafting of a mission statement. All family members need to agree to the terms set out in the statement, which should memorialize the family’s philosophy, purpose and values.

The document should include a description of the following:

- each member’s duties and responsibilities;

- the process for making decisions affecting the family’s wealth (e.g., investments and which philanthropic causes to support);

- a process for communicating;

- a plan for teaching younger family members about the responsibilities that come with their wealth; and

- a list of people the family office will employ to oversee its operations and the process for hiring those individuals who will support the office.

Step 3: Put the team in place.

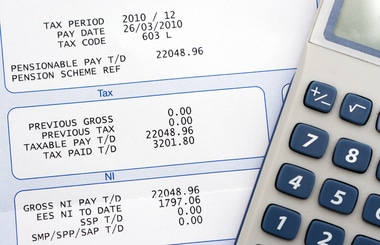

Some family offices budget as much as $1 million to put a team in place, but it can be done for much less, depending on the scope of duties and the number of full-time employees. However the family office is organized, the team should be composed of qualified advisors, including an accountant experienced in wealth planning, a trust and estate attorney, a banker and a financial advisor.

Click here to contact us today if you’re ready to set up a family office that protects your wealth.

©2021