Under IRS and Department of Labor rules, employers whose 401(k) plans have over 120 eligible participants on the first day of the plan year must hire an Independent Qualified Public Accountant (IQPA) to audit the plan for that year. (This is part of the so-called 80-120 rule, which governs plans with between 80 and 120 participants, as of the first day of the plan year.) These mandatory audits can uncover 401(k) processes needing improvement and help you avoid penalties from the IRS or DOL.

Whether or not you’re legally required to perform 401(k) audits, it’s a good idea to self-audit your plan periodically throughout the year.

When self-auditing the plan, do not miss these six areas.

1. Plan document

Employers with 401(k) plans must adopt and maintain a written plan document that provides essential information about the plan, including criteria for eligibility, contributions, vesting, loans, hardship withdrawals and distributions.

Audit check:

Is your plan document up to date? Are your day-to-day 401(k) transactions adhering to the plan document?

2. Participation eligibility

If an employee meets the established eligibility standards for 401(k) participation — such as the ones regarding age and length of service — he or she must be allowed to participate in the plan.

Audit check:

Do all participants satisfy the eligibility standards, including the rules established by the IRS? Remember as well that the SECURE Act says employers must allow eligible long-term, part-time employees to participate in the company’s 401(k) plan, starting in 2024. Employers must begin tracking part-time employees’ work hours in 2021 to determine eligibility for the 2024 start date.

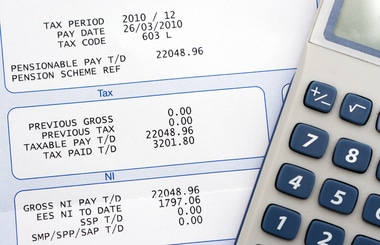

3. 401(k) contributions

Employee and employer contributions cannot exceed the limits defined by the IRS.

Audit check:

Are employees’ 401(k) contributions accurately deducted from their paychecks? Are employer contributions (if applicable) paid to employees as promised? Are contributions properly recorded on pay stubs, Form W-2s, employment tax filings and the company’s financial statements?

4. Deposits of 401(k) deferrals

According to the IRS, “Department of Labor rules require that the employer deposit deferrals to the trust as soon as the employer can; however, in no event can the deposit be later than the 15th business day of the following month.”

Audit check:

Are you paying 401(k) deferrals on time?

5. 401(k) distributions

Plan distributions must be made based on IRS rules and the terms stated in the plan document.

Audit check:

Are participants who receive distributions eligible to receive them? Are you handling hardship withdrawals, 401(k) loans, required minimum distributions and taxes on early distributions appropriately?

6. Employee notices

Employers must give participants certain information about the 401(k) plan.

Audit check:

Have participants received the necessary disclosures, including the summary plan description, summary annual report and annual fee disclosure notice? Are special notices, such as the ones for automatic enrollment, required? What about employee consent?

On a final note

If your 401(k) plan must undergo annual discrimination testing, be sure to implement internal audit controls to prevent the plan from failing the test. Also, if you use service providers for 401(k) administration, it’s important to coordinate with them to ensure ongoing compliance.

How BlueStone Services Can Help

Keep in mind this is a general overview of a complex series of provisions. Work closely with legal and financial experts to make sure you are following all the rules. Contact us to see how our HR and accounting professionals can help you manage your 401K compliance requirements.