The second relief bill, passed at the end of 2020, contains updates to the employee retention credit, a refundable payroll tax credit. Each option has its own rules and regulations for first- and second-round funding. The act changes some requirements for the ERC — retroactively and prospectively — giving businesses more options to claim it.

Eligibility Updates

Not every business qualifies for this credit. To be eligible, it must meet either of these criteria:

- The business was fully or partially suspended due to orders from the federal or state government limiting commerce, travel or group meetings due to COVID-19.

- The business experienced a 50% year-over-year decline in gross receipts during any quarter of 2020 or a 20% decline in the first two quarters of 2021 compared with the same period in 2019.

In addition:

- Certain governmental employers (e.g., state colleges, universities, hospitals) are now eligible for this credit.

- Certain businesses that were started in response to the pandemic may be able to claim the credit.

Small or Large Business?

If your business is eligible, the next step is determining whether you qualify as a small or a large business. The definitions of business size changed under the act. For 2020, businesses with 100 or fewer employees were considered small businesses, but the act changed that. For 2021, businesses with up to 500 employees are classified as small businesses.

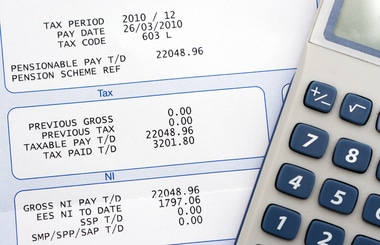

Dollar Limits

For eligible small businesses, wages paid in 2020 are eligible for a 50% credit. That changes to 70% in 2021. For eligible large businesses, only wages paid to employees who were furloughed or not working qualify for the credit. Otherwise, the limits are the same: 50% for wages paid in 2020 and 70% for wages paid in 2021.

Wages paid to some employees who work at a level below their normal qualifications may also qualify.

The maximum credit is $5,000 for tax year 2020 and $7,000 per quarter for each of the first two quarters of 2021.

Other Major Changes to the ERC

- Businesses can take the ERC even if they borrowed PPP funds. This change is retroactive for wages paid after March 12, 2020. There is a caveat: Businesses may not take a double deduction. That is, they may not use the same wages for the ERC as they do for PPP loan forgiveness.

- The ERC was extended through June 30, 2021.

- Businesses may use the immediately preceding quarter to determine eligibility.

This is just a summary of some complex provisions that may affect how a business works with other relief programs. To make sure you’re making the best use of any programs for your business, be sure to get professional advice.

If you have any questions about this information please contact BlueStone by clicking here.

©2021