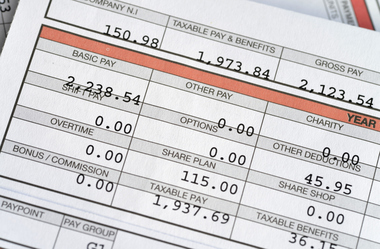

Understanding payroll tax rates and contribution limits is crucial for both employees and employers as it directly impacts financial planning, compliance with tax regulations, and overall fiscal responsibility. Payroll taxes fund essential government programs such as Social Security and Medicare, making it essential to grasp the rates and limits associated with these contributions. Staying informed empowers individuals to manage their finances effectively, ensures businesses comply with tax regulations, and supports the continued funding of critical government programs. For your convenience below is a list of payroll tax rates and contribution limits for 2024 to review and consider.

Social Security Payroll Tax Rates for 2024

Social Security Payroll Tax Rates for 2024

In 2024, the Social Security payroll tax rate is 6.2% for employers and employees, unchanged from 2023. The Social Security wage base is $168,600 for employers and employees, increasing from $160,200 in 2023. Self-employed people must pay 12.4% on the first $168,600.

Medicare Payroll Tax Rates for 2024

In 2024, the Medicare payroll tax rate for employers and employees is 1.45% of all wages, unchanged from 2023. Self-employed people must pay 2.9% on all net earnings.

Additional Medicare Payroll Tax Rates for 2024

In 2024, the additional Medicare tax remains unchanged at 0.9%. This tax applies to wages and self-employment income over certain thresholds ($200,000 for single filers and $250,000 for joint filers).

401(k) Contribution Limits for 2024

In 2024, the maximum contribution limit to traditional and safe harbor plans is as follows:

- Employee (age 49 or younger): $23,000, up from $22,500 in 2023.

- Employee catch-up (age 50 or older): $7,500, unchanged from 2023.

- Employee and employer (age 49 or younger): $69,000, up from $66,000 in 2023.

- Employee and employer (age 50 or older): $76,500, up from $73,500 in 2023.

Employees can contribute up to $16,000 to a SIMPLE 401(k) plan, up from $15,500 in 2023.

Health Savings Account and High-Deductible Health Plan Contribution Limits for 2024

In 2024, the maximum contribution limit to an HSA is as follows:

- Employer and employee: $4,150 (self only) and $8,300 (family).

- Catch-up amount (age 55 or older): $1,000.

In 2024, the contribution limits for an HDHP are as follows:

- Minimum deductibles: $1,600 (self only) and $3,200 (family).

- Maximum out-of-pocket amounts: $8,050 (self only) and $16,100 (family).

Flexible Spending Account Contribution Limits for 2024

In 2024, employees can contribute:

- Up to $3,200 to a health care FSA, increasing from $3,050 in 2023.

- Up to $5,000 to a dependent care FSA if filing single or jointly and up to $2,500 if married but filing separately.

Qualified Small Employer Health Reimbursement Arrangement Contribution Limits for 2024

In 2024, employers with a QSEHRA can reimburse employees for health care expenses as follows:

- $6,150 (self only), up from $5,850 in 2023.

- $12,450 (family), up from $11,800 in 2023.

Commuter Benefits Contribution Limit for 2024

In 2024, employees can contribute up to $315 per month for qualified commuter benefits (e.g., mass transit and parking), up from $300 per month in 2023. This limit includes any employer contributions.

Adoption Assistance Exclusion Contribution Limit for 2024

In 2024, up to $16,810 in employer-sponsored adoption assistance may be excluded from an employee’s gross wages, increasing from $15,950 in 2023.

Remember, these are all federal payroll tax rates and contribution limits. Be sure to check with the necessary agencies for state and local rates.

How BlueStone Services Can Help

Note that this is a summary of some very complex provisions. Don’t make any assumptions about your situation until you’ve spoken with a qualified tax consultant like the team at BlueStone Services. Our HR and Accounting teams simplify payroll management by staying ahead of tax and contribution changes, ensuring seamless integration into your systems. We keep employees informed, collaborate with finance for accuracy, and can conduct regular audits to guarantee compliance. With outsource support, we can help your payroll run smoothly year-round.

Contact us today to learn more about how the payroll tax rates and contribution limits for 2024 can affect your business.