Medical practices should prioritize these 5 time-sensitive projects for the first quarter of 2021. Ever-changing government regulations, technological innovations, and reporting deadlines will continue to significantly influence your practice’s environment. It is important to focus on these operational items and monitor them with a comprehensive approach to avoid costly errors. Below, BlueStone’s medical service consulting division provides further comments on why all practices should focus on these important tasks.

The 5 urgent operational issues that need attention are as follows:

1. Mandatory Department of Health and Human Services (HHS) Stimulus Reporting

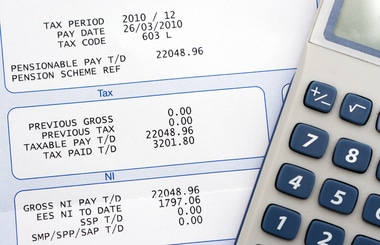

Beginning 1/15/21 and ending 2/15/21 (with a final reporting due on 7/31/21 if monies received have not been fully expended by 12/31/20) reporting will be required by all medical/dental practices who received money from the HHS Stimulus funding sources.

To date, the information provided regarding the HHS Provider Relief Fund (PRF) has been painstakingly complex. PRF recipients could apply the funds to any healthcare-related expenses during COVID-19 that were not reimbursed or due to be reimbursed by other sources (e.g. SBA PPP Loan). In addition, funds could be used toward any lost revenues up to the difference between 2020 and 2019 patient care revenues. The PRF attestation requires recipients to apply certain financial management standards, including record retention requirements and tracking of funding stream expenditures. As we have been reporting since second quarter 2020, practices should have developed policies and procedures so that they are able to identify, document, and report allowable expenses and/or lost revenue during calendar year 2020.

Before going on the portal to start your registration process, providers should review the registration guide and have the following information available, click here to view and download our HHS Stimulus Reporting Update and Information Required to Register information.

2. Major Overhaul to CMS Medicare Physician Fee Schedule

Do you know how this will affect your 2021 revenue? On December 27th, the Consolidated Appropriations Act, 2021 again modified the Physician Fee Schedule (MPFS) for Calendar Year (CY) 2021. In turn, CMS recalculated the MPFS payment rates to include a 3.75% increase in payments for CY 2021 and revised the MPFS conversion factor from $32.41 to $34.89. This latest reimbursement change was NOT consistently applied to all codes so an analysis will have to be performed for your practice’s particular utilization of CPT codes. This will directly affect your Medicare revenue as well as any other revenue you receive that is based on Medicare rates.

3. 2021 E&M Coding and Documentation Major Overhaul

Has your EMR vendor made the necessary adjustments to account for these changes? Have your providers been trained on the documentation changes that took effect on 1/1/21? If not, this could cost your practice revenue and could set your practice up for audit risk. Coding revisions have ultimately reshaped the physician note for E&M visits by narrowing the components for code selection to medical decision-making (MDM) and total time on the day of encounter. Without proper EMR adjustments and provider training, practices’ documentation might not meet the new requirements.

4. Loan Forgiveness Analysis for 2020 PPP1 Loan

It is time to consider when to submit your PPP1 forgiveness applications. Several of the issues that make the standard application for forgiveness so confusing and time-consuming have now been removed for small borrowers (<$50,000 in loan proceeds). Read more about the new PPP Loan Forgiveness Form 3508S – To Simplify Forgiveness Process for Small Businesses. The SBA is in the process of changing this form to include loans less than $150,000. We are awaiting confirmation that the simplified form has been revised to include PPP loans less than $150,000 which includes a majority of PPP borrowers.

5. PPP2 – Is your Practice Eligible for another PPP Loan?

Funds are limited so act now once you decide if you qualify. PPP2 will be available to businesses with 300 or fewer employees, whose gross receipts declined by 25% or more in any one quarter during 2020 compared to the same quarter in 2019. The window for applying opened on 1/11/21. It is important to prepare your analysis now to see if your practice can qualify for additional assistance if there is financial uncertainty and need. Applying can be a bit complicated if you received HHS stimulus during 2020 based on when it was received. We can help you work through this process to determine your eligibility. Read more on PPP2, click here.

We strongly recommend a comprehensive approach when applying for and reporting all of these items. In particular, bullets 1, 4, 5 need to be coordinated so your practice is reporting your expenses (and lost revenue) correctly and most advantageously.

Some common scenarios to be aware of are:

- Payroll Expenses and PPP Forgiveness vs. HHS Stimulus reporting – If you use only Payroll expenses for PPP forgiveness you cannot use the same Payroll dollars for HHS stimulus usage. As a result, will there be an ample amount of other qualified expenses to satisfy HHS stimulus (PRF) reporting? (Review more reporting details here.)

- Accurate reporting to qualify for PPP2 – If lost revenue occurred in one quarter but stimulus funds were received in another, you could qualify for the second-draw PPP loan if it is reported correctly and there is still financial uncertainty and need. There are still some unanswered questions about what qualifies as income and how that affects your loan eligibility.

Many of these items influence each other and it is important that you consider all of your financial results when applying or reporting. If not documented and processed correctly it could result in a loss of funds or forgiveness. To leverage your dollars to the fullest extent and protect your practice in 2021 and beyond you should: (1) review these items as a complete picture, and (2) work with financial and legal advisors who are monitoring them.

How Can BlueStone Services Help with Time-Sensitive Medical Practice Projects?

In the ever-changing healthcare landscape, you need a firm that can not only solve the complex problems of today but can also help you plan and innovate for the future. With the mission to provide quality education, training, management, and consulting services that will enable practices to improve their performance, we offer a wide variety of services to physicians and their practices. Visit our BlueStone Services page to learn more. Please let us know how we can help you!

To have a BlueStone Services MBa Consultant discuss your practice’s situation, click here.