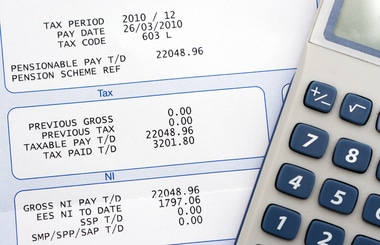

You can generally deduct the amount you pay your employees for the services they perform. The pay may be in cash, property or services. It may include wages, salaries, bonuses, commissions or other noncash compensation such as vacation allowances and fringe benefits.

A fringe benefit is a form of pay for the performance of services beyond your employees’ normal rate of pay and can be property, services, cash or cash equivalents such as savings bonds. It can also be intangible, as in the use of a company car or life insurance.

You may deduct fringe benefit expenses if the goods, services or facilities are treated as compensation to the recipient and reported on Form W-2 for an employee or Form 1099-NEC for an independent contractor. (If the recipient is an officer, director or beneficial owner — directly or indirectly — or other specified individual, special rules apply.)

Let’s take a look at specific fringe benefits:

- Meals and lodging — Generally, you can deduct 50% of certain meal expenses and 100% of certain lodging expenses provided to your employees. If the amounts are deductible, deduct the cost in whatever category the expense falls. You can deduct the full cost of the following meals:

- Meals you furnish employees as part of providing recreational or social activities.

- Meals you furnish employees at a work site where you operate a restaurant or catering service.

However, with food and beverage expenses incurred with entertainment expenses, no business deduction is allowed for any item considered to be entertainment, amusement or recreation. If food and beverages are provided during an entertainment activity, the food has to be separate from the entertainment costs, and then you may deduct 50% of the bill. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for a temporary 100% deduction until Jan. 1, 2023.

- Transportation (commuting) benefits — Providing transportation via a commuter highway vehicle, transit passes or qualified parking are no longer deductible. No deduction is allowed for any expense incurred for transportation, reimbursement or in connection with travel to get to work, except when it means the safety of your employee or for qualified bicycle commuting reimbursement.

- Employee benefit programs — For accident and health plans, adoption assistance, cafeteria plans, assistance for dependent care or education, life insurance coverage, and welfare benefit funds, you can generally deduct the amounts you spend in whatever categories they fall. However, you can’t deduct life insurance for any person with a financial interest in your business if you’re directly or indirectly the beneficiary of the policy. For welfare benefit funds, your deduction for contributions is limited to the fund’s qualified cost for the tax year. If your contributions are more than its qualified cost, carry the excess over to the next tax year.

How can BlueStone Services help?

This is just a summary — there are many other exceptions and provisions. Since laws and regulations are complicated and can change with little notice, be sure to seek professional advice to ensure that your benefits are reported and taxed properly. BlueStone Services can provide virtual or onsite outsourced accounting services based on your specific needs.