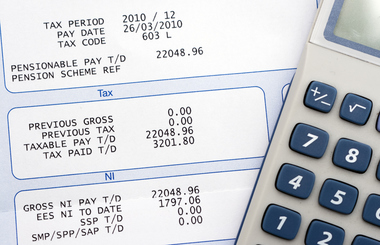

It’s important for businesses to have a clear and consistent pay frequency schedule to ensure fairness and adherence to labor laws and employee expectations.

A lack of structure around paychecks could throw off budgeting and financial planning processes or put a business at risk of legal issues for possible violations of labor laws.

- Time commitment: The more frequently you pay employees, the more time you spend running payroll.

- Money: Some software companies charge based on the number of payrolls you run each month.

Pay Frequency Options

- Weekly: An employee paid weekly receives 52 paychecks per year. The U.S. Bureau of Labor Statistics says 33.3% of employees receive weekly paychecks, making it the second most popular pay frequency.

- Biweekly: You pay employees every other week, so they receive 26 paychecks per year, or two each month — except for two months when they get three. Workers receive their pay on the same day of the week each pay period. BLS says biweekly is the most popular pay frequency, with 43% of employees receiving their wages biweekly.

- Semimonthly: Employees are paid twice per month, but the key difference is that they receive 24 paychecks per year. You pay employees on specific dates; those dates may differ. Usually, you’ll pay workers on the 15th and the 30th of each month. 19% of employees receive their wages on a semimonthly basis.

- Monthly: Employees receive one paycheck per month — 12 per year. Monthly paychecks are for larger amounts but are paid less frequently. Only 4.7% of employees are paid monthly, making it the least common pay frequency.

Choosing The Correct Pay Frequency

Consistency rules. You must maintain a consistent pay frequency. You cannot change an employee’s pay frequency when you feel like it. States determine what pay frequencies you can and can’t use. Most states set a minimum pay frequency you must follow:

- Arizona requires that employers pay employees two or more days per month, not more than 16 days apart.

- In California, wages (with some exceptions) must be paid at least twice during each calendar month on the days designated in advance as regular paydays.

- Texas employers must pay each employee who is exempt from overtime provisions of the Fair Labor Standards Act at least once a month; others must be paid at least twice a month. Semimonthly pay periods must contain, as nearly as possible, an equal number of days. Within those limitations, employers may designate any payday they choose

Your employees and payment approach. Employee-related factors may impact the pay frequency you go with.

- Among businesses with 1,000-plus employees, 67% use biweekly. For businesses with one to nine employees, 39% choose biweekly.

- You can establish different pay frequencies for salaried employees vs. hourly employees.

- Your industry: The industry in which you operate can determine your pay frequency. Certain industries tend to pay weekly, while others pay monthly.

- The BLS says that 65% of construction employers pay on a weekly basis, while only 14% of employers in finance do.

How you run payroll. If you run payroll by hand, shorter pay frequencies — weekly, for instance — require more payroll runs, taking more time and energy.

- Some companies that service payrolls add charges per payroll run, making you pay more for weekly payrolls than biweekly ones.

Check how potential payroll vendors charge — per employee or per paycheck — because it matters. Aside from keeping consistency (the only requirement by federal law) uppermost in your mind, you must also abide by state rules.

Provide clear information on when payments will be made to help employees manage their finances.

How BlueStone Services Can Help

If you need help with payroll consulting and pay frequency, consider working with us!

Let us take care of your daily accounting tasks and make sure all the financial figures are up-to-date! With our transactional management services, you can focus on more important goals without worrying about missing a beat in keeping track of your finances.

Contact us today to get started on discussing pay frequency.